Multiple Choice

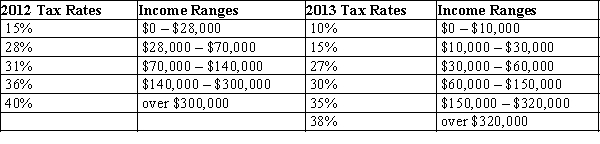

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.

-Refer to Table 12-9. Darby is a single person whose taxable income is $320,000 a year. What happened to her average tax rate between 2012 and 2013?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

Correct Answer:

Verified

Related Questions

Q454: Table 12-9

United States Income Tax Rates for

Q455: Table 12-9

United States Income Tax Rates for

Q456: Table 12-8

The following table presents the total

Q457: Table 12-9

United States Income Tax Rates for

Q458: Table 12-9

United States Income Tax Rates for

Q460: Table 12-8

The following table presents the total