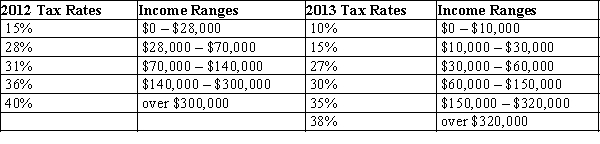

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.

-Refer to Table 12-9. Jake is a single person whose taxable income is $20,000 a year. What happened to his average tax rate between 2012 and 2013?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

Correct Answer:

Verified

Q449: Table 12-9

United States Income Tax Rates for

Q450: Table 12-9

United States Income Tax Rates for

Q451: Table 12-9

United States Income Tax Rates for

Q452: Table 12-9

United States Income Tax Rates for

Q453: Table 12-9

United States Income Tax Rates for

Q455: Table 12-9

United States Income Tax Rates for

Q456: Table 12-8

The following table presents the total

Q457: Table 12-9

United States Income Tax Rates for

Q458: Table 12-9

United States Income Tax Rates for

Q459: Table 12-9

United States Income Tax Rates for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents