During 2010, Pine Corporation had the following transactions and events:

1. Issued par value preferred stock for cash at par value.

2. Issued par value common stock for cash at an amount greater than par value.

3. Completed a 2 for 1 stock split in which the $10 par value common stock was changed to $5 par value stock.

4. Declared a small stock dividend when the market value was higher than the par value.

5. Declared a cash dividend.

6. Made a prior period adjustment for understatement of net income.

7. Issued par value common stock for cash at par value.

8. Paid the cash dividend.

9. Issued the shares of common stock required by the stock dividend declaration in 4. above.

Instructions

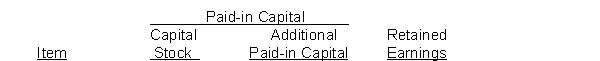

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answers in tabular form with the following columns. Use (I) for increase, (D) for decrease, and (NE) for no effect.

Correct Answer:

Verified

Q122: Which of the following statements about retained

Q137: Norman Corporation had 250,000 shares of common

Q139: Each of the following statements is correct

Q140: Devons Company has 24,000 shares of $1

Q142: Reese Company reported retained earnings at December

Q143: Harrington Company reported the following balances at

Q144: On January 1, 2010, Penton Corporation had

Q145: The following information is available for Ritter

Q146: Derek Corporation was organized on January 1,

Q247: Dillon Corporation splits its common stock 2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents