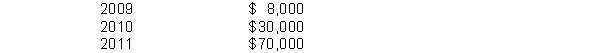

Derek Corporation was organized on January 1, 2009. During its first year, the corporation issued 40,000 shares of $5 par value preferred stock and 400,000 shares of $1 par value common stock. At December 31, the company declared the following cash dividends:

Instructions

(a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 5% and not cumulative.

(b) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 6% and cumulative.

(c) Journalize the declaration of the cash dividend at December 31, 2011 using the assumption of part (b).

Correct Answer:

Verified

Q141: During 2010, Pine Corporation had the following

Q142: Reese Company reported retained earnings at December

Q143: Harrington Company reported the following balances at

Q144: On January 1, 2010, Penton Corporation had

Q145: The following information is available for Ritter

Q147: The following information is available for Ellis

Q148: On January 1, 2010, Dolan Corporation had

Q149: The following accounts appear in the ledger

Q150: Richman Corporation has 120,000 shares of $5

Q151: The following information is available for Piper

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents