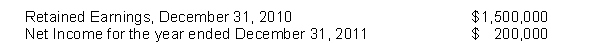

The following information is available for Piper Corporation:

The company accountant, in preparing financial statements for the year ending December 31, 2011, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2009 and 2010 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $20,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2011.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2011.

Correct Answer:

Verified

Q146: Derek Corporation was organized on January 1,

Q147: The following information is available for Ellis

Q148: On January 1, 2010, Dolan Corporation had

Q149: The following accounts appear in the ledger

Q150: Richman Corporation has 120,000 shares of $5

Q152: In 2010, Worthington Corporation had net sales

Q153: The following information is available for Wenger

Q154: The following financial information is available for

Q155: On January 1, 2010, Vannon Corporation had

Q156: On November 1, 2010, Norris Corporation's stockholders'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents