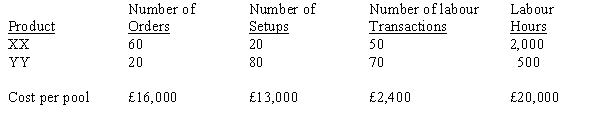

Hunter Company manufactures two products (XX and YY). The overhead costs have been divided into four cost pools that use the following activity drivers:  Required:

Required:

a.

Compute the allocation rates for each of the activity drivers listed.

b.

Allocate the overhead costs to Products XX and YY using activity-based costing.

c.

Compute the overhead rate using labour hours under the traditional functional-based costing system.

d.

Allocate the overhead costs to Products XX and YY using the traditional functional-based costing system overhead rate calculated in part (c).

Correct Answer:

Verified

Q46: Activity-based costing assigns costs to cost object

Q49: Batch-related costs are added to which of

Q49: Discuss how volume-based unit-level analysis underestimates and/or

Q51: Briefly discuss the problem with the unit-level

Q52: Lyons, SA., has identified the following overhead

Q54: Funk Manufacturing Company produces specially machined parts.

Q55: Compare and contrast traditional organization-based costing with

Q56: Hill Manufacturing uses an activity-based costing system.

Q57: Godwin Ltd. produces specially machined parts. The

Q58: Describe the unit level approach to cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents