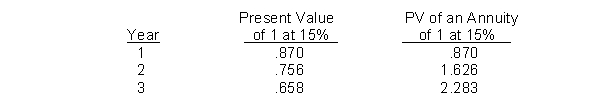

Sloan Inc. recently invested in a project with a 3-year life span. The net present value was $9,000 and annual cash inflows were $21,000 for year 1; $24,000 for year 2; and $27,000 for year 3. The initial investment for the project, assuming a 15% required rate of return, was

A) $45,792.

B) $45,180.

C) $29,232.

D) $38,376.

Correct Answer:

Verified

Q47: The higher the risk element in a

Q61: When the annual cash flows from an

Q64: The discount rate that will result in

Q66: When a capital budgeting project generates a

Q68: Companies often assume that the risk element

Q71: If a project has a salvage value

Q73: A negative net present value indicates that

Q74: The primary capital budgeting method that uses

Q76: Which of the following will increase the

Q79: Johnson Corp. has an 8% required rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents