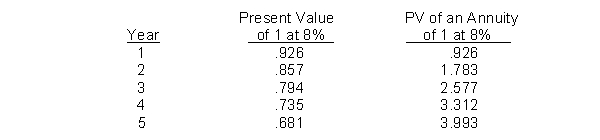

Johnson Corp. has an 8% required rate of return. It's considering a project that would provide annual cost savings of $50,000 for 5 years. The most that Johnson would be willing to spend on this project is

A) $125,910.

B) $165,600.

C) $199,650.

D) $34,050.

Correct Answer:

Verified

Q61: When the annual cash flows from an

Q64: The discount rate that will result in

Q68: Companies often assume that the risk element

Q73: A negative net present value indicates that

Q74: The primary capital budgeting method that uses

Q75: Sloan Inc. recently invested in a project

Q82: To avoid rejecting projects that actually should

Q83: Intangible benefits in capital budgeting

A) should be

Q84: In evaluating high-tech projects,

A) only tangible benefits

Q88: The profitability index is computed by dividing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents