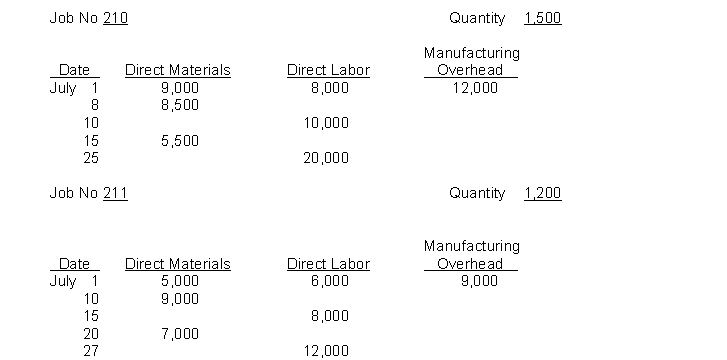

Job cost sheets for Howard Manufacturing are as follows:

Instructions

(a) Answer the following questions.

1. What was the balance in Work in Process Inventory on July 1 if these were the only unfinished jobs?

2. What was the predetermined overhead rate in June if overhead was applied on the basis of direct labor cost?

3. If July is the start of a new fiscal year and the overhead rate is 20% higher than in the preceding year, how much overhead should be applied to Job 210 in July?

4. Assuming Job 210 is complete, what is the total and unit cost of the job?

5. Assuming Job 211 is the only unfinished job at July 31, what is the balance in Work in Process Inventory on this date?

(b) Journalize the summary entries to record the assignment of costs to the jobs in July. (Note: Make one entry in total for each manufacturing cost element.)

Correct Answer:

Verified

Q144: During 2016 Arb Company incurred the following

Q162: Watson Manufacturing Company employs a job order

Q163: At May 31, 2017, the accounts of

Q164: The manufacturing operations of Beatly, Inc. had

Q166: Selected accounts of Kosar Manufacturing Company at

Q167: Garner Company begins operations on July 1,

Q168: A job cost sheet of Fugate Company

Q169: Finn Manufacturing Company uses a job order

Q170: Graham Manufacturing is a small manufacturer that

Q180: Fort Corporation had the following transactions during

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents