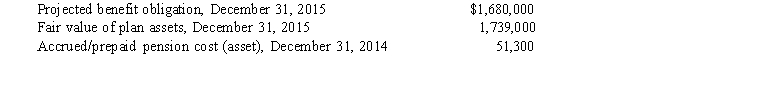

The Peanut Company has a defined benefit pension plan for its employees. The following information pertains to the pension plan:  The December 31, 2015 adjusting journal entries include a

The December 31, 2015 adjusting journal entries include a

A) debit to Accrued/Prepaid Pension Cost for $7,700.

B) debit to Other Comprehensive Income for $7,700.

C) credit to Other Comprehensive Income for $110,300.

D) credit to Accrued/Prepaid Pension Cost for $110,300.

Correct Answer:

Verified

Q41: Vested benefits are

A)estimated benefits

B)not contingent on future

Q42: Which of the following statements is true?

A)Funding

Q45: John Company adopted a defined benefit pension

Q46: If a company uses the indirect method

Q47: Exhibit 19-02

The Sophia Company adopted a defined

Q50: A company must fund its pension plan

Q51: Exhibit 19-01

Marley Co. has an underfunded prepaid/accrued

Q52: Exhibit 19-01

Marley Co. has an underfunded prepaid/accrued

Q54: The Pension Benefit Guaranty Corporation's purpose is

Q57: Current GAAP requires that the net gain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents