At December 31, 2016, the Blue Agave Company had a current deferred tax asset of $60,000, arising from cash for magazine subscriptions received and taxed in 2016 but that will be recognized as income for accounting purposes in

2017; a noncurrent deferred tax liability of $160,000 arising from an excess of MACRS tax depreciation over straight-line accounting depreciation of plant assets; and a long-term deferred tax asset of $80,000, arising from contingency expenses for accounting purposes that will be tax deductible when paid estimated to be in 2018). The

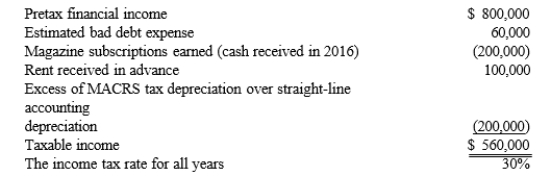

2017 pretax financial income and taxable income for Blue Agave are as follows:  Required:

Required:

Prepare the income tax journal entry for the Blue Agave Company at the end of 2017.

Correct Answer:

Verified

Q92: Rice, Inc. began operations on January 1,

Q93: Thorn Corporation has deductible and taxable temporary

Q94: The following information relates to the Kill

Q95: Fairfax Company had a balance in Deferred

Q96: At the end of the current year,

Q98: On December 31, 2016, the Town Hall

Q99: James Company reports the following information related

Q100: Jefferson Corporation reported the following pretax and

Q101: What should a corporation disclose for the

Q102: Identify the three essential characteristics of an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents