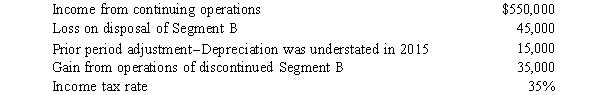

Lakeland Corporation reported the following pretax and taxable) information for 2016:  Required:

Required:

a. Prepare the lower portion of Lakeland's 2016 income statement, beginning with pretax income for continuing operations. Omit the heading.)

b. Prepare Lakeland's 2016 statement of retained earnings, assuming that retained earnings at January 1, 2016, was $750,000 and the company paid $45,000 of dividends in 2016. Omit the heading.)

Correct Answer:

Verified

Q84: What two objectives did the FASB identify

Q85: At the end of its first year

Q86: Differences arising between financial accounting and tax

Q87: In order to implement the FASB's objectives

Q88: Describe the process for determining deferred tax

Q90: At the end of its first year

Q91: Delmarva Company, during its first year of

Q92: Rice, Inc. began operations on January 1,

Q93: Thorn Corporation has deductible and taxable temporary

Q94: The following information relates to the Kill

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents