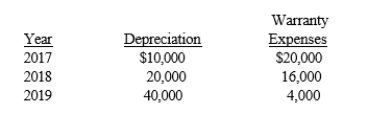

Delmarva Company, during its first year of operations in 2016, reported taxable income of $170,000 and pretax financial income of $100,000. The difference between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows:  Enacted tax rates are 30% for 2016, 35% for 2017 and 2018, and 40% for 2019.

Enacted tax rates are 30% for 2016, 35% for 2017 and 2018, and 40% for 2019.

Required:

Prepare the income tax journal entry for Delmarva Company for December 31, 2016.

Correct Answer:

Verified

Q86: Differences arising between financial accounting and tax

Q87: In order to implement the FASB's objectives

Q88: Describe the process for determining deferred tax

Q89: Lakeland Corporation reported the following pretax and

Q90: At the end of its first year

Q92: Rice, Inc. began operations on January 1,

Q93: Thorn Corporation has deductible and taxable temporary

Q94: The following information relates to the Kill

Q95: Fairfax Company had a balance in Deferred

Q96: At the end of the current year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents