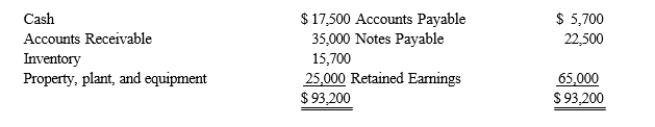

Boggs Company is looking to purchase the Grafton Company below is their balance sheet at December 31, 2015.

Boggs Company is looking to purchase the Grafton Company for $150,000 cash. The fair value of their equipment is

$35,600, the fair value of their inventory is $20,000, their accounts receivable fair value is $24,500, and they have an unrecorded patent of $15,000. All other book values equal fair value as of January 1, 2015.  Required:

Required:

1.) Compute the goodwill associated with the purchase of Grafton.

2.) Prepare the journal entry necessary at January 1, 2015 to record the purchase of Grafton.

3.) What if the purchase price was $69,000 would any goodwill be reported?

Correct Answer:

Verified

3.) If the purchase price was $69,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: The determination of impairment losses differs under

Q97: Development costs related to computer software that

Q98: Development costs related to computer software that

Q100: Which statement about negative goodwill is true?

A)

Q101: Melissa Company, which was organized in January

Q103: Grier purchased Walters Company several years ago.

Q104: What factors should a company consider when

Q105: Costs associated with various intangibles of a

Q106: The CMS Co. began operations in January

Q107: The Ripkin Corporation was organized and began

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents