Exhibit 11-05

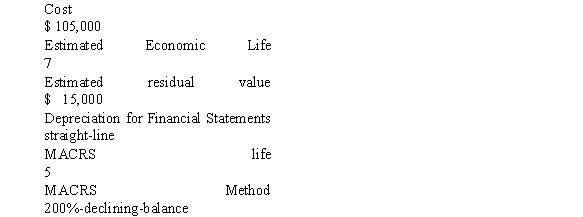

Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, Year 1.

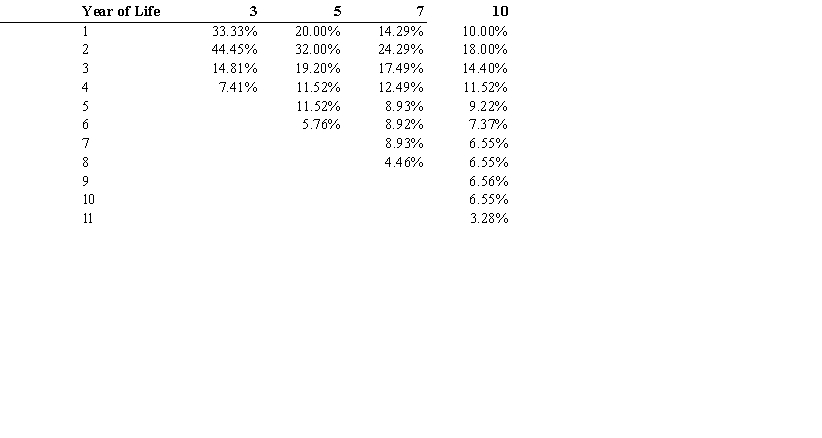

MACRS Depreciation as a Percentage of the Cost of the Asset

-Refer to Exhibit 11-05, what amount of depreciation would be recorded on the income tax returns for year 3?

A) $12,096

B) $21,000

C) $33,600

D) $20,160

Correct Answer:

Verified

Q63: Depletion of a natural resource is typically

Q73: The MACRS differs from straight-line depreciation computed

Q88: When must a company recognize an impairment

Q89: Which of the following costs can be

Q91: Exhibit 11-03

On January 1, 2016, Wheeler, Inc.

Q92: In 2016, Western Maryland Company paid $3,000,000

Q94: The impairment loss for an asset that

Q95: Exhibit 11-05

Wilson is preparing his tax returns

Q96: Exhibit 11-05

Wilson is preparing his tax returns

Q98: The following are a list of terms:

_

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents