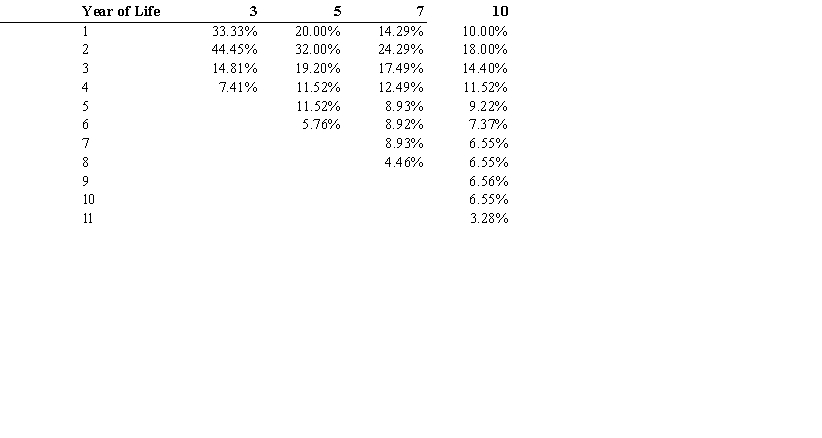

Exhibit 11-05

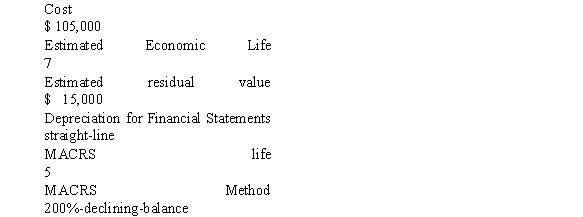

Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, Year 1.

MACRS Depreciation as a Percentage of the Cost of the Asset

-Refer to Exhibit 11-05, what amount of depreciation would have been recorded in Wilson's books for year 3?

A) $18,000

B) $12,857

C) $20,160

D) $15,000

Correct Answer:

Verified

Q63: Depletion of a natural resource is typically

Q73: The MACRS differs from straight-line depreciation computed

Q91: Exhibit 11-03

On January 1, 2016, Wheeler, Inc.

Q92: In 2016, Western Maryland Company paid $3,000,000

Q93: Exhibit 11-05

Wilson is preparing his tax returns

Q94: The impairment loss for an asset that

Q96: Exhibit 11-05

Wilson is preparing his tax returns

Q98: The following are a list of terms:

_

Q99: Exhibit 11-04

Kieso Company purchased a tract of

Q100: Choice Mining Co. paid $9,000 for some

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents