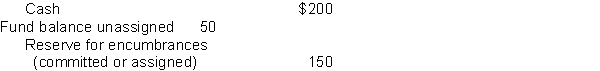

Assume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The county formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the county had the following balances in its accounts. All amounts are in thousands.

REQUIRED: Prepare the necessary entries for the current fiscal year.  (a) The county made the appropriate entry to restore the prior-year purchase commitments.

(a) The county made the appropriate entry to restore the prior-year purchase commitments.

(b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750.

(c) The county received the items that had been ordered in the prior year at an actual cost of $135.

(d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70.

(e) The county incurred salaries and other operating expenses during the year totaling $600. The county paid these items in cash.

(f) The county received the equipment at an actual cost of $75.

(g) The county earned and collected, in cash, revenues of $810.

Correct Answer:

Verified

Q45: Kayla County prepares its general fund financial

Q46: Hill City uses encumbrance accounting to control

Q47: A review of Park City's books shows

Q48: In which of the following cases would

Q49: Carolina City places an order for a

Q51: Geneva County authorized the issuance of bonds

Q52: School District #25 formally integrates the budget

Q53: Assume that the City of Pasco maintains

Q54: Which of the following is the primary

Q55: The town of Terry began 2016 with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents