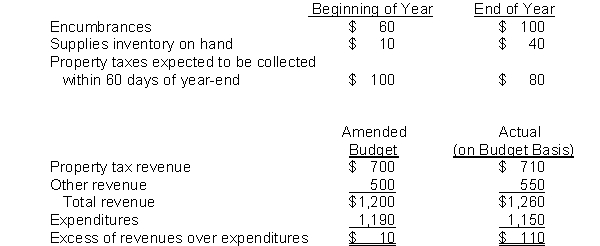

Kayla County prepares its general fund financial reports in accordance with generally accepted accounting principles (GAAP) but its budgetary basis for the general fund differs from GAAP. The budget-to-actual comparison for the general fund is presented below. All numbers are in thousands.

REQUIRED: Prepare the GAAP-basis operating statement for the general fund.

(a) For budgetary purposes, the county recognizes encumbrances as expenditures in the year of the purchase commitment; it recognizes supplies as expenditures when acquired. For budgetary purposes the county recognizes all revenues in the fiscal year collected.

For GAAP-basis financial reporting, the county recognizes supplies as expenditures as consumed. It recognizes property taxes as revenue if they are collected within 60 days of fiscal year-end. All other revenues are recognized on the cash basis for GAAP.

(b) The following additional information is available.

Correct Answer:

Verified

Q40: During the previous year, Bane County closed

Q41: Washington County received goods that had been

Q42: The City of Denton uses encumbrance accounting

Q43: Lincoln County uses encumbrance accounting to control

Q44: Many governments budget on the cash basis.

Q46: Hill City uses encumbrance accounting to control

Q47: A review of Park City's books shows

Q48: In which of the following cases would

Q49: Carolina City places an order for a

Q50: Assume that the County of Katerah maintains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents