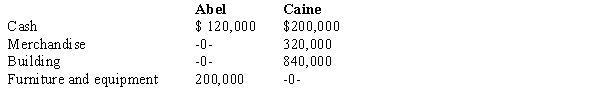

The partnership of Abel and Caine was formed on February 28, 2017. At that date the following assets were invested:  The building is subject to a mortgage loan of $280,000, which is to be assumed by the partnership. The partnership agreement provides that Abel and Caine share profits or losses 30% and 70%, respectively. Caine's capital account at February 28, 2017, should be

The building is subject to a mortgage loan of $280,000, which is to be assumed by the partnership. The partnership agreement provides that Abel and Caine share profits or losses 30% and 70%, respectively. Caine's capital account at February 28, 2017, should be

A) $1,080,000.

B) $1,360,000.

C) $1,176,000.

D) $952,000.

Correct Answer:

Verified

Q2: Bob and Fred form a partnership and

Q3: In a partnership, interest on capital investment

Q4: The partnership agreement of Powell, Gaunt, and

Q5: The partnership of Gilligan, Skipper, and Ginger

Q6: The profit and loss sharing ratio should

Q7: At December 31, 2017, Mick and Keith

Q8: A partnership in which one or more

Q9: When the goodwill method is used to

Q10: The partnership of Gilligan, Skipper, and Ginger

Q11: The bonus and goodwill methods of recording

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents