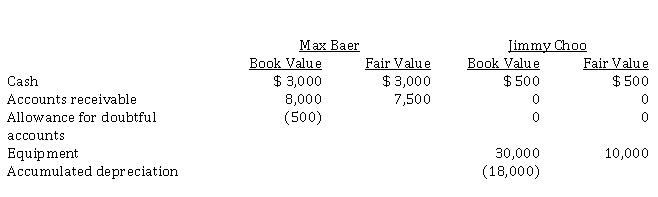

Max Baer and Jimmy Choo are two proprietors who decide to merge their businesses into a partnership on January 1, 2021. The assets each contributed to the partnership are as follows:  During the year ended December 31, 2021, the business, Bear-Chew Pet Services, had revenues of $ 180,000, rent expenses of $ 12,000, depreciation expense of $ 2,500, and other operating expenses of $ 8,400. Other than depreciation expense, all revenues and expenses incurred by the business were for cash. As well, cash of $ 7,500 was collected on the accounts receivable, with the remainder of the accounts receivable written off. The partnership agreement specifies that Max and Jimmy will share the partnership profit equally. During the year, Max withdrew $ 40,000 for personal use, and Jimmy withdrew $ 28,000.

During the year ended December 31, 2021, the business, Bear-Chew Pet Services, had revenues of $ 180,000, rent expenses of $ 12,000, depreciation expense of $ 2,500, and other operating expenses of $ 8,400. Other than depreciation expense, all revenues and expenses incurred by the business were for cash. As well, cash of $ 7,500 was collected on the accounts receivable, with the remainder of the accounts receivable written off. The partnership agreement specifies that Max and Jimmy will share the partnership profit equally. During the year, Max withdrew $ 40,000 for personal use, and Jimmy withdrew $ 28,000.

Instructions

a) Prepare the journal entry to record the two partners' contributions on January 1, 2021.

b) Prepare the partnership's income statement, statement of partners' equity, and balance sheet at December 31, 2021.

Correct Answer:

Verified

Q149: Marty Cummerford and Jane Wheeler have formed

Q150: Cleaning

Q151: The following information is available regarding CGG

Q152: The following condensed adjusted trial balance relates

Q153: Arnold Black and Sam Smith operate separate

Q155: The condensed, adjusted trial balance of the

Q156: Peter and Paul have a partnership agreement

Q157: Jane Zhou, Ron Higgins, and Liz O'Neill

Q158: Joanne and Diane have a partnership in

Q159: Pac-link Technologies is a partnership owned and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents