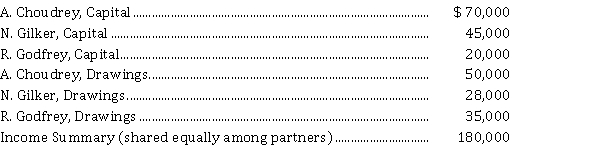

The following information is available regarding CGG Company's partnership accounts at December 31, 2021, before completion of the closing entries:  No new contributions were made during 2021. Godfrey wishes to withdraw from the partnership January 1, 2022.

No new contributions were made during 2021. Godfrey wishes to withdraw from the partnership January 1, 2022.

Instructions

a) Prepare the statement of partners' equity for the year ended December 31, 2021.

b) Prepare the January 1, 2022 entry to record Godfrey's withdrawal under each of the following three independent alternatives:

(i) Choudrey and Gilker each pay Godfrey $ 10,000 out of their personal accounts and each receives one-half of Godfrey's equity.

(ii) Godfrey is paid $ 100,000 out of partnership cash.

(iii) Godfrey is paid $ 40,000 out of partnership cash.

Correct Answer:

Verified

Q146: Bob Spade and Ken Lundy have formed

Q147: On January 1, 2020, Steve Furlong and

Q148: At September 30, 2021, C. Saber and

Q149: Marty Cummerford and Jane Wheeler have formed

Q150: Cleaning

Q152: The following condensed adjusted trial balance relates

Q153: Arnold Black and Sam Smith operate separate

Q154: Max Baer and Jimmy Choo are two

Q155: The condensed, adjusted trial balance of the

Q156: Peter and Paul have a partnership agreement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents