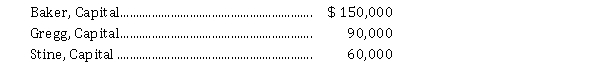

Baker, Gregg, and Stine share profit and losses in a ratio of 4:1:5, respectively. The capital account balances of the partners are as follows:  Instructions

Instructions

Prepare the journal entry on the books of the partnership to record the withdrawal of Stine under the following independent circumstances:

a) The partners agree that Stine should be paid $ 70,000 by the partnership for his interest.

b) The partners agree that Stine should be paid $ 45,000 by the partnership for his interest.

c) Baker agrees to pay Stine $ 40,000 for one-half of his capital interest and Gregg agrees to pay Stine $ 40,000 for one-half of his capital interest in personal transactions among the partners.

Correct Answer:

Verified

Q147: At June 30, Fine Balance Partnership is

Q161: The ABC Partnership is to be liquidated

Q163: Julie Ellis, Sara Lake, and Dan Madden

Q164: Jabar Hassan, Mohammed Badoo, and Sanji Patel

Q165: Tim Tarrant and Jim Edmonds share partnership

Q166: The Felix and Morris Partnership has capital

Q168: Petra Stone and Pam Peach are partners

Q169: The RAD Partnership is to be liquidated

Q170: Sam Bilbo and Edmond Lewis who operate

Q171: Match the items below by entering the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents