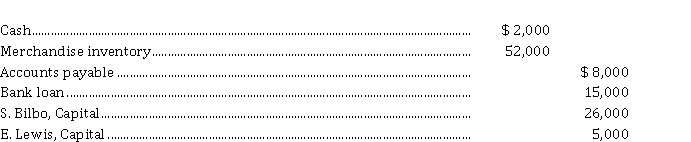

Sam Bilbo and Edmond Lewis who operate the Shire Partnership have decided to liquidate their business and retire. Sam and Edmond allocate profit and losses on a 3:2 basis, respectively. At December 31, 2020, after all closing entries have been made, the trial balance of the partnership shows the following account balances:  The inventory is sold on January 1, 2021 for cash, and the liabilities are paid. Both partners have the resources to cover deficits (if any) in their capital accounts.

The inventory is sold on January 1, 2021 for cash, and the liabilities are paid. Both partners have the resources to cover deficits (if any) in their capital accounts.

Instructions

a) Assuming the inventory is sold for $ 25,000, calculate the balance in each partner's capital account after allocating the gain or loss on sale of inventory and payment of the liabilities. Prepare the entry to record the receipt of cash from, or payment of cash to, each partner to liquidate the partnership.

b) Assuming the inventory is sold for $ 57,000, calculate the balance in each partner's capital account after allocating the gain or loss on sale of inventory and payment of the liabilities. Prepare the entry to record the receipt of cash from, or payment of cash to, each partner to liquidate the partnership.

Correct Answer:

Verified

Q147: At June 30, Fine Balance Partnership is

Q161: The ABC Partnership is to be liquidated

Q163: Julie Ellis, Sara Lake, and Dan Madden

Q164: Jabar Hassan, Mohammed Badoo, and Sanji Patel

Q165: Tim Tarrant and Jim Edmonds share partnership

Q166: The Felix and Morris Partnership has capital

Q167: Baker, Gregg, and Stine share profit and

Q168: Petra Stone and Pam Peach are partners

Q169: The RAD Partnership is to be liquidated

Q171: Match the items below by entering the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents