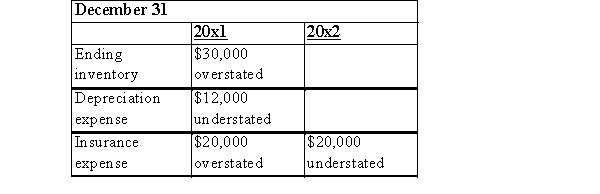

BVC began operations January 1, 20x1.Financial statements for the year ended December 31, 20x1, and 20x2, contained the following errors:  In addition, on December 26, 20x2, fully depreciated machinery was sold for $21,600 cash, but the sale was not recorded until 20x3. There were no other errors during 20x1 or 20x2, and no corrections have been made for any of the errors.

In addition, on December 26, 20x2, fully depreciated machinery was sold for $21,600 cash, but the sale was not recorded until 20x3. There were no other errors during 20x1 or 20x2, and no corrections have been made for any of the errors.

What is the total pre-tax effect of the errors on 20x2 net income?

A) $71,600 Overstated

B) $50,000 Overstated

C) $53,600 Overstated

D) $28,400 Overstated

Correct Answer:

Verified

Q21: Depreciation expense for the most recent fiscal

Q22: At the end of Year 1, ABC

Q23: A change from the sum-of-the-years'-digits depreciation method

Q24: Which of the following is not an

Q25: Which of the following is not an

Q27: MMC changed depreciation methods from straight-line to

Q28: On December 25, 20x2, JKL ordered merchandise

Q29: An asset that cost $66,000 was being

Q30: XYZ decided to change its depreciation policy

Q31: When a firm changes only the estimated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents