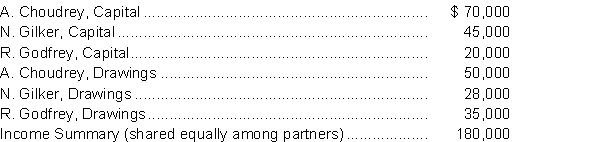

The following information is available regarding CGG Company's partnership accounts at December 31, 2014, before completion of the closing entries:  No new contributions were made during 2014. Godfrey wishes to withdraw from the partnership January 1, 2015.

No new contributions were made during 2014. Godfrey wishes to withdraw from the partnership January 1, 2015.

Instructions

a. Prepare the statement of partners' equity for the year ended December 31, 2014.

b. Prepare the January 1, 2015 entry to record Godfrey's withdrawal under each of the following three independent alternatives:

(i) Choudrey and Gilker each pay Godfrey $10,000 out of their personal accounts and each receives one half of Godfrey's equity.

(ii) Godfrey is paid $100,000 out of partnership cash.

(iii) Godfrey is paid $40,000 out of partnership cash.

Correct Answer:

Verified

Q140: At September 30, 2014, C. Saber and

Q141: Baker, Gregg, and Stine share profit and

Q142: The Felix and Morris Partnership has capital

Q143: Donna Karr, Alice Wright, and Nancy Shaffer

Q144: Tim Tarrant and Jim Edmonds share partnership

Q146: The RAD Partnership is to be liquidated

Q147: At June 30, Fine Balance Partnership is

Q148: Julie Ellis, Sara Lake, and Dan Madden

Q149: Connie Knox and Andrea Cardoza have capital

Q150: Jackie Thompson and Rick Chung are partners

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents