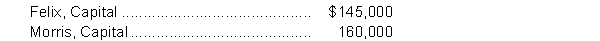

The Felix and Morris Partnership has capital account balances as follows:  The partners share profit and losses in the ratio of 60% to Felix and 40% to Morris.

The partners share profit and losses in the ratio of 60% to Felix and 40% to Morris.

Instructions

Prepare the journal entry on the books of the partnership to record the admission of Singh as a new partner under the following three independent circumstances:

a. Singh pays $80,000 to Felix and $95,000 to Morris for one-half of each of their ownership interests in a personal transaction.

b. Singh invests $150,000 in the partnership for a one-third interest in partnership capital.

c. Singh invests $1,000,000 in the partnership for a one-third interest in partnership capital.

Correct Answer:

Verified

Q137: The liquidation of a partnership ends the

Q138: A capital deficiency may be caused by

A)

Q139: Jane Zhou, Ron Higgins and Liz O'Neill

Q140: At September 30, 2014, C. Saber and

Q141: Baker, Gregg, and Stine share profit and

Q143: Donna Karr, Alice Wright, and Nancy Shaffer

Q144: Tim Tarrant and Jim Edmonds share partnership

Q145: The following information is available regarding CGG

Q146: The RAD Partnership is to be liquidated

Q147: At June 30, Fine Balance Partnership is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents