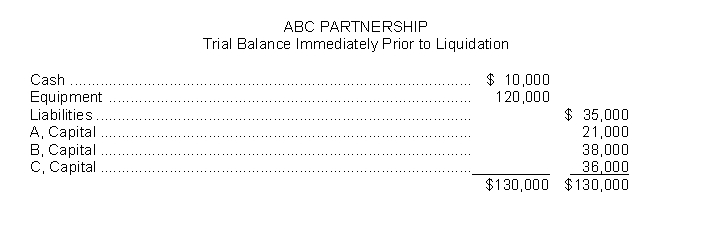

The ABC Partnership is to be liquidated and you have been hired to prepare a Schedule of Cash Payments for the partnership. Partners A, B, and C share profit and losses in the ratio of 6:2:2 respectively. Assume the following:

1. Equipment was sold for $80,000.

2. Liabilities were paid in full.

3. The remaining cash was distributed to the partners. (If any partner has a capital deficiency, assume that the partner is unable to make up the capital deficiency.)  Instructions

Instructions

Using the above information, calculate the following:

a. Cash available to be distributed to all partners.

b. Any gain or loss on sale of noncash assets.

c. The amount of cash to be received by each partner upon liquidation.

Correct Answer:

Verified

Q143: Donna Karr, Alice Wright, and Nancy Shaffer

Q144: Tim Tarrant and Jim Edmonds share partnership

Q145: The following information is available regarding CGG

Q146: The RAD Partnership is to be liquidated

Q147: At June 30, Fine Balance Partnership is

Q148: Julie Ellis, Sara Lake, and Dan Madden

Q149: Connie Knox and Andrea Cardoza have capital

Q150: Jackie Thompson and Rick Chung are partners

Q151: Sam Bilbo and Edmond Lewis who operate

Q153: Match the items below by entering the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents