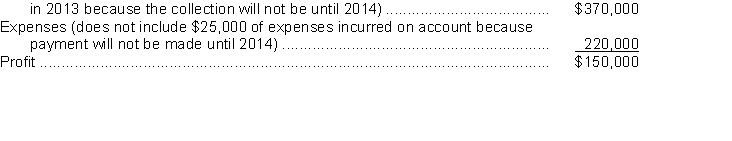

Roberts Company prepared the following income statement using the cash basis of accounting:

ROBERTS COMPANY

Income Statement, Cash Basis

Year Ended December 31, 2013

_____________________________________________________________________________

Service revenue (does not include $40,000 of services performed on account  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On July 1, 2013, paid for a one-year insurance policy on the automobile amounting to $1,800. This amount is included in the expenses above.

Instructions

a. Prepare Roberts Company's income statement on the accrual basis in conformity with generally accepted accounting principles. Show calculations and explain each change.

b. Explain which basis (cash or accrual) provides a better measure of profit.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: The adjusted trial balance of Amin Company

Q149: Allen Coat Company purchased a delivery truck

Q150: The Larson Company prepared the following income

Q151: You receive $45,000 in year 1 for

Q152: Ellis Company accumulates the following adjustment data

Q154: The Shockers, a semi-professional baseball team, prepare

Q155: Callison Company has an accounting fiscal year

Q156: On December 31, 2013, Polski Company prepared

Q157: Pierson Insurance Agency prepares monthly financial statements.

Q158: The Upton Company accumulates the following adjustment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents