The Upton Company accumulates the following adjustment data at December 31.

1. Revenue of $1,100 collected in advance has been earned.

2. Salaries of $600 are unpaid.

3. Prepaid rent totalling $450 has expired.

4. Supplies of $550 have been used.

5. Revenue earned but unbilled totals $750.

6. Utility expenses of $300 are unpaid.

7. Interest of $250 has accrued on a note payable.

Instructions

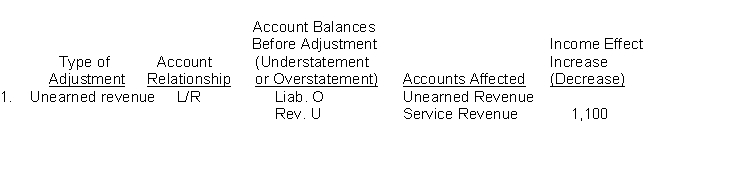

a. For each of the above items indicate:

i. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

ii. The account relationship (asset/liability, liability/revenue, etc.).

iii. The status of account balances before adjustment (understatement or overstatement).

iv. The accounts that will be affected.

v. The profit effect.

Prepare your answer in the tabular form presented below. The first item is shown for illustrative purposes.

b. Assume Profit before the adjustments listed above was $21,500. What is the adjusted Profit?

Correct Answer:

Verified

Q153: Roberts Company prepared the following income statement

Q154: The Shockers, a semi-professional baseball team, prepare

Q155: Callison Company has an accounting fiscal year

Q156: On December 31, 2013, Polski Company prepared

Q157: Pierson Insurance Agency prepares monthly financial statements.

Q159: The following situations are independent:

1. Jane's Drywall

Q160: The following amounts are taken from the

Q161: The adjusted trial balance of Jacks Financial

Q162: Rubber Company prepares quarterly financial statements. It

Q163: In 2013, Micro Marvels signed a $70,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents