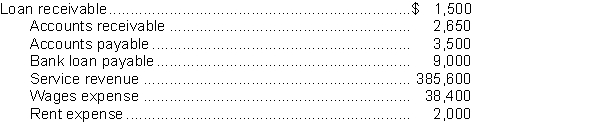

In January 2014, Edward started a business providing home repair services. The business is called Helpful Handyman, and the service is so popular that he has already hired 10 additional employees after being in business for just six months. On May 1 he rented an office with storage space for tools and supplies. It is now the end of June and he must prepare financial statements to present to his banker. The following amounts are taken from Helpful Handyman's unadjusted trial balance at June 30, 2014. Assume all accounts are their normal balance (Debit or Credit).  Additional information about the accounting records:

Additional information about the accounting records:

1. The loan receivable was made to an employee on June 1 and the employee is to pay interest at 12% annually in monthly instalments starting July 1.

2. Edward normally invoices customers when the jobs are complete. At June 30, there was $5,000 of work that had been completed near month end for which invoices had not yet been issued.

3. The bank loan bears interest at 6% and was taken out on April 1. Interest payments are due quarterly, so no interest has yet been paid.

4. The last pay day before June 30 was on June 25. Since then, the 10 employees have worked an average of 25 hours each, at a wage of $8.50 per hour.

5. Rent is $2,000 per month. The June rent has not yet been paid.

Instructions:

a. Prepare any adjusting entries required at June 30, 2014 based on the above information. Accounts not listed above may need to be set up.

a. Indicate whether the ending balances are Debit or Credit.

b. Calculate the adjusted balances of the accounts listed above and any new accounts set up in part

c. Assuming that unadjusted Profit of Helpful Handyman is $60,000. Calculate the adjusted Profit after the adjustments above have been made.

Correct Answer:

Verified

Q159: The following situations are independent:

1. Jane's Drywall

Q160: The following amounts are taken from the

Q161: The adjusted trial balance of Jacks Financial

Q162: Rubber Company prepares quarterly financial statements. It

Q163: In 2013, Micro Marvels signed a $70,000

Q165: The following ledger accounts are used by

Q166: Presented below are the trial balance and

Q167: Lamburg Company has prepared the following adjusting

Q168: For the following independent situations, prepare the

Q169: The following ledger accounts are used by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents