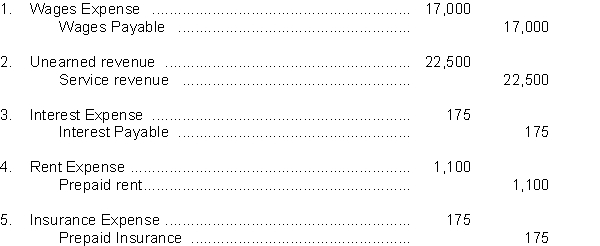

Lamburg Company has prepared the following adjusting entries at its fiscal year end on June 30, 2014.  The adjustment for depreciation has not yet been prepared for the current year. Lamburg's building was purchased 7 years ago. Lamburg follows straight-line depreciation and for the past 6 years depreciation has been properly recorded. The Land was purchased 11 years ago.

The adjustment for depreciation has not yet been prepared for the current year. Lamburg's building was purchased 7 years ago. Lamburg follows straight-line depreciation and for the past 6 years depreciation has been properly recorded. The Land was purchased 11 years ago.

Instructions

a. Prepare an adjusting entry to record depreciation expense.

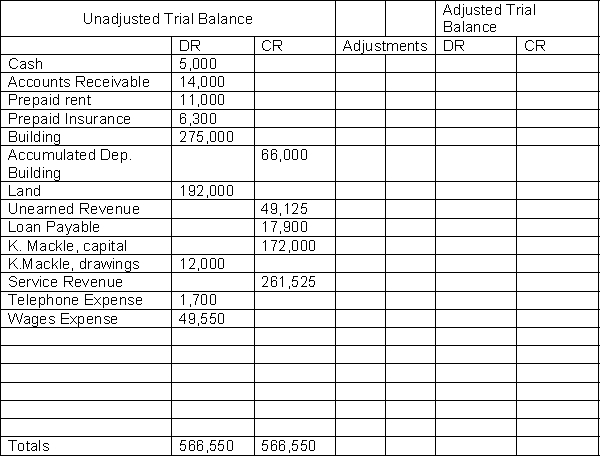

b. Using the chart below prepare an adjusted trial balance in the last two columns. Use the middle two columns to record any increases and decreases to the account from the adjusting entries. If additional accounts are needed, add them at the bottom of the list of accounts in the trial balance.

c. Prepare an income statement, statement of owner's equity and a balance sheet.

Correct Answer:

Verified

Depreciation Expense 11,000

Accumulat...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q162: Rubber Company prepares quarterly financial statements. It

Q163: In 2013, Micro Marvels signed a $70,000

Q164: In January 2014, Edward started a business

Q165: The following ledger accounts are used by

Q166: Presented below are the trial balance and

Q168: For the following independent situations, prepare the

Q169: The following ledger accounts are used by

Q170: The total weekly payroll for Fly-By Airlines

Q171: Prepare the required end-of-period adjusting entries for

Q172: The following amounts are taken from the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents