Mercy Corporation, headquartered in State F, sells wireless computer devices, including keyboards and bar code readers. Mercy's degree of operations is sufficient to establish income tax nexus only in States E and F. Determine its sales factor in those states.

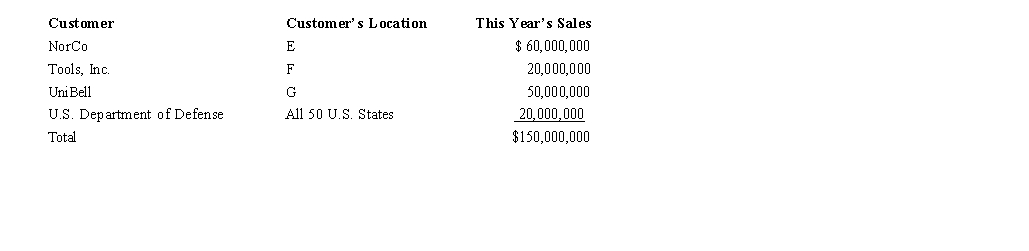

State E applies a throwback rule to sales, but State F does not. State G has not adopted an income tax to date. Mercy reported the following sales for the year. All of the goods were shipped from Mercy's F manufacturing facilities.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q161: Provide the required information for Orange Corporation

Q162: Franz Corporation is based in State A

Q163: Kim Corporation, a calendar year taxpayer,

Q164: Compost Corporation has finished its computation of

Q165: Pail Corporation is a merchandiser. It

Q167: Garcia Corporation is subject to income

Q168: Drieser Corporation's manufacturing facility, distribution center,

Q169: Hambone Corporation is subject to the

Q170: Discuss how a multistate business divides its

Q171: You are completing the State A

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents