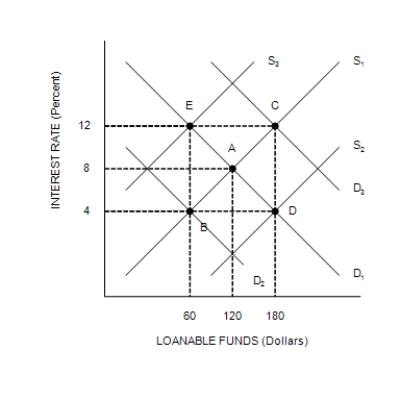

Figure 26-4

This figure shows the loanable funds market for a closed economy.

-Refer to Figure 26-4. Starting at point A, the enactment of an investment tax credit would likely cause the quantity of loanable funds traded to

A) increase to $180 and the interest rate to rise to 12% (point C) .

B) decrease to $60 and the interest rate to fall to 4% (point B) .

C) decrease to $60 and the interest rate to rise to 12% (point E) .

D) increase to $180 and the interest rate to fall to 4% (point D) .

Correct Answer:

Verified

Q215: In 2002 mortgage rates fell and mortgage

Q216: Figure 26-2

The figure depicts a supply-of-loanable-funds curve

Q217: If the nominal interest rate is 8

Q218: If the demand for loanable funds shifts

Q219: Figure 26-3

The figure shows two demand-for-loanable-funds curves

Q220: A larger budget deficit

A)raises the interest rate

Q221: Figure 26-3

The figure shows two demand-for-loanable-funds curves

Q223: Figure 26-3

The figure shows two demand-for-loanable-funds curves

Q224: Figure 26-4

This figure shows the loanable funds

Q225: Figure 26-3

The figure shows two demand-for-loanable-funds curves

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents