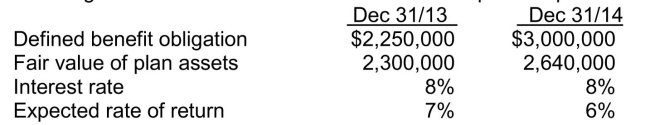

Pension plan calculations The following information relates to the defined benefit pension plan for Strawberry Dale Ltd.:  In 2014, the corporation contributed $390,000 to the plan, and the trustee paid $210,000 in benefits to retirees.Strawberry Dale uses the immediate recognition approach under IFRS. Instructions For the year ended December 31, 2014:

In 2014, the corporation contributed $390,000 to the plan, and the trustee paid $210,000 in benefits to retirees.Strawberry Dale uses the immediate recognition approach under IFRS. Instructions For the year ended December 31, 2014:

a.Calculate the interest on the obligation.

b.Calculate the actual return on plan assets.

c.Calculate the unexpected gain or loss (if any).

Correct Answer:

Verified

Q65: Deferred tax asset

a) Describe a deferred tax

Q67: Taxable income and accounting income

Explain the difference

Q71: Taxable temporary difference

Explain what a taxable temporary

Q75: Pension accounting terminology

Briefly explain the following terms

a)

Q250: Stock dividends and stock splits Indicate the

Q251: Interim reporting There is ongoing discussion as

Q252: Segmented reporting Tangerine Corporation's most recent (condensed)income

Q254: Taxable loss carryforward with valuation allowance (ASPE)

Q257: Internet financial reporting Other Measurement and Disclosure

Q260: Deferred income taxes Nebraska Ltd., at the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents