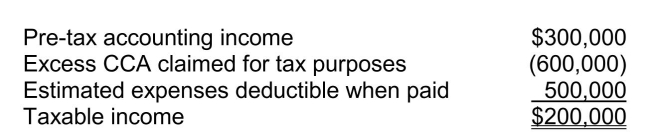

Deferred income taxes Nebraska Ltd., at the end of 2014, its first year of operations, prepared a reconciliation between pre-tax accounting income and taxable income as follows:  Use of the depreciable assets will result in taxable amounts of $200,000 in each of the next Income Taxes 18- 29 three years.The estimated expenses of $500,000 will be deductible in 2017 when settlement is expected to be made. The enacted tax rate is 25% and is not expected to change. Instructions

Use of the depreciable assets will result in taxable amounts of $200,000 in each of the next Income Taxes 18- 29 three years.The estimated expenses of $500,000 will be deductible in 2017 when settlement is expected to be made. The enacted tax rate is 25% and is not expected to change. Instructions

a.Prepare a schedule of the deferred taxable and deductible amounts.

b.Prepare the required adjusting journal entries to record income taxes for 2014.

Correct Answer:

Verified

Q65: Deferred tax asset

a) Describe a deferred tax

Q67: Taxable income and accounting income

Explain the difference

Q71: Taxable temporary difference

Explain what a taxable temporary

Q75: Pension accounting terminology

Briefly explain the following terms

a)

Q250: Stock dividends and stock splits Indicate the

Q251: Interim reporting There is ongoing discussion as

Q252: Segmented reporting Tangerine Corporation's most recent (condensed)income

Q254: Taxable loss carryforward with valuation allowance (ASPE)

Q257: Internet financial reporting Other Measurement and Disclosure

Q259: Pension plan calculations The following information relates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents