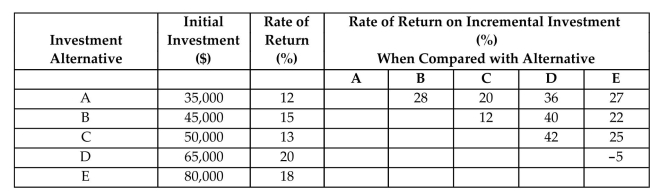

You are evaluating five investment projects. You already calculated the rate of return for each alternative

investment and incremental rate of return between the two-paired alternatives as well. In calculating the

incremental rate of return, a lower cost investment project is subtracted from the higher cost investment project.

All rate of return figures are rounded to the nearest integers.  (a) If all investment alternatives are mutually independent and the MARR is 10%,

(a) If all investment alternatives are mutually independent and the MARR is 10%,

which projects would be selected?

(b) If all investment alternatives are mutually exclusive and the MARR is 12%, which alternative should be

chosen?

(c) Suppose all investment alternatives are mutually exclusive but the MARR is 25%, which alternative should

be chosen?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The following information on two mutually exclusive

Q6: You are considering purchasing a CNC machine

Q7: Consider the following two investment situations:

• In

Q8: The following infinite cash flow has a

Q9: A manufacturing firm is considering two types

Q10: Consider the following project cash flows.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents