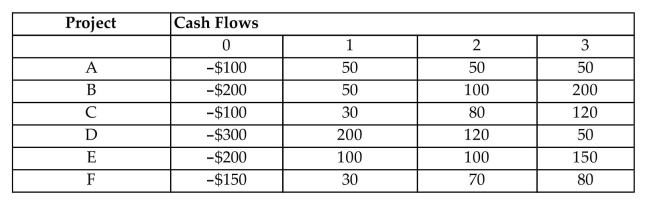

Consider the following investment projects and their interdependencies:  Projects A and B are mutually exclusive.

Projects A and B are mutually exclusive.

Projects C and F are independent projects

Project D is contingent on Project C.

Project E is contingent on project B.

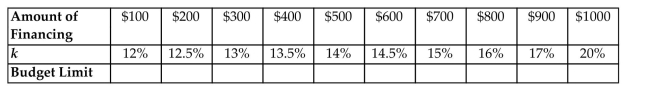

The following indicates the cost of capital as a function of budget:  The firm has lending opportunities at 9%.

The firm has lending opportunities at 9%.

Formulate the entire list of mutually exclusive decision alternatives.

What is the optimal capital budget? Which projects would be funded under the optimal capital budget?

If the firm has a budget limit placed at $600, which projects would be funded? What is the appropriate MARR?

Correct Answer:

Verified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents