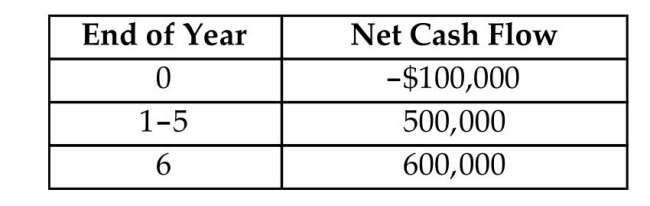

You are considering purchasing industrial equipment to expand one of your production lines. The equipment

costs $100,000 and has an estimated service life of 6 years. Assuming that the equipment will be financed

entirely from your business-retained earnings (equity funds), a fellow engineer has calculated the expected

after tax cash flows, including the salvage value, at the end of its project life are as follows:  Now you are pondering the possibility of financing the entire amount by borrowing from a local bank at 12%

Now you are pondering the possibility of financing the entire amount by borrowing from a local bank at 12%

interest. You can make an arrangement to pay only the interest each year over the project period by deferring

the principal payment until the end of 6 years. Your firm's interest rate is also 12%. The expected marginal

income tax rate over the project period is known to be 40%. What is the amount of economic gain (or loss) in

present worth by using debt financing over equity financing?

Correct Answer:

Verified

Q2: A corporation is considering purchasing a machine

Q3: A special purpose machine tool set would

Q4: Which of the following statements is most

Q5: You are planning to lease an automobile

Q6: Lane Construction Ltd. is considering the acquisition

Q7: Cutter Ltd. is planning to invest $150,000

Q8: Oxford Manufacturing Company needs an air compressor

Q9: Consider the following financial data for an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents