(continuation with the Purchasing Power Parity question from Chapter 4)

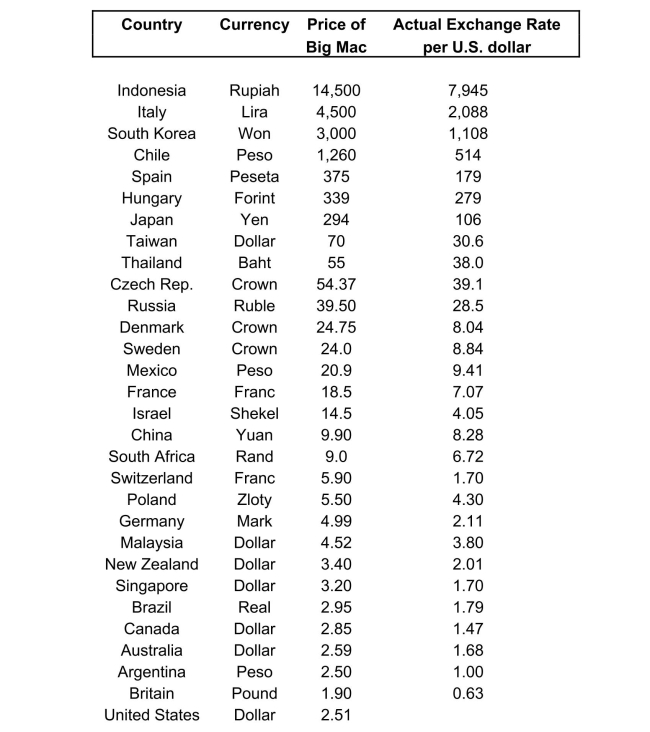

The news-magazine The Economist regularly publishes data on the so called Big

Mac index and exchange rates between countries.The data for 30 countries from

the April 29, 2000 issue is listed below:  The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. 16

The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. 16

After entering the data into your spread sheet program, you calculate the predicted

exchange rate per U.S.dollar by dividing the price of a Big Mac in local currency

by the U.S.price of a Big Mac ($2.51).To test for PPP, you regress the actual

exchange rate on the predicted exchange rate.

The estimated regression is as follows: (a)Your spreadsheet program does not allow you to calculate heteroskedasticity

robust standard errors.Instead, the numbers in parenthesis are homoskedasticity

only standard errors.State the two null hypothesis under which PPP holds.Should

you use a one-tailed or two-tailed alternative hypothesis?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: If the errors are heteroskedastic, then

A)OLS is

Q35: (Continuation from Chapter 4, number 6)The

Q36: For the following estimated slope coefficients

Q38: Below you are asked to decide

Q39: (Continuation from Chapter 4, number 5)

Q41: Changing the units of measurement obviously

Q42: (Requires Appendix material) Your textbook shows

Q43: The neoclassical growth model predicts that

Q44: Your textbook discussed the regression model

Q59: Your textbook states that under certain restrictive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents