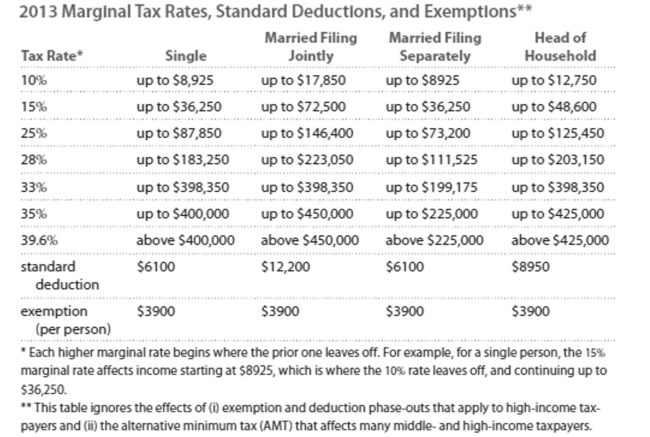

Solve the problem. Refer to the table if necessary.

-Carla earned wages of $53,687, received $1731 in interest from a savings account, and contributed $ 2999 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $7180. Find her gross income.

A) $58,417

B) $52,419

C) $41,339

D) $55,418

Correct Answer:

Verified

Q117: Calculate the balance under the given assumptions.

-Find

Q118: Determine whether the spending pattern described is

Q119: Solve.

-Determine how much of the total loan

Q120: Find the monthly interest payments in

Q121: You need a loan of $100,000

Q123: Solve the problem. Refer to the

Q124: Solve the problem. Refer to the

Q125: Solve.

-Determine the total payment over the term

Q126: Answer the question.

-You could take a 15-week,

Q127: Use the compound interest formula for compounding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents