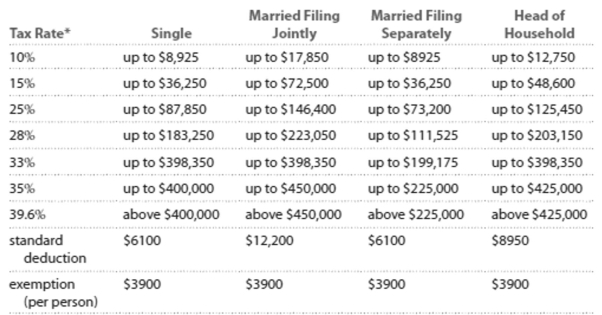

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to \$36,250.

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Kyle is single and earned wages of $34,036. He received $362 in interest from a savings account. He contributed $549 to a tax-deferred retirement plan. He had $405 in itemized deductions from

Charitable contributions. Calculate his adjusted gross income.

A) $34,947

B) $34,542

C) $33,849

D) $33,444

Correct Answer:

Verified

Q119: Solve.

-Determine how much of the total loan

Q120: Find the monthly interest payments in

Q121: You need a loan of $100,000

Q122: Solve the problem. Refer to the table

Q123: Solve the problem. Refer to the

Q125: Solve.

-Determine the total payment over the term

Q126: Answer the question.

-You could take a 15-week,

Q127: Use the compound interest formula for compounding

Q128: Solve the equation for the unknown

Q129: Use the compound interest formula for continuous

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents