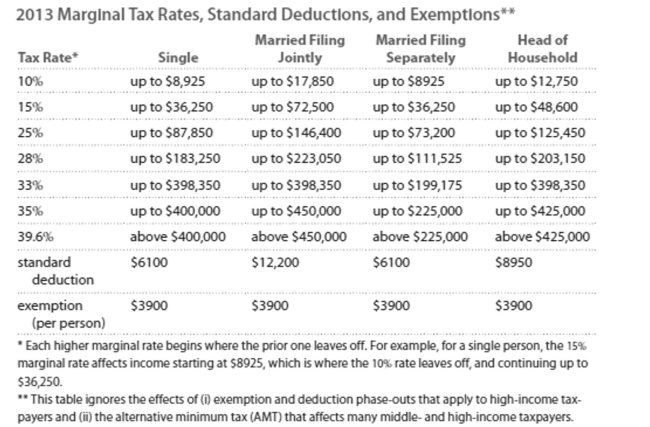

Solve the problem. Refer to the table if necessary.

-Carmen and James are married and filed jointly. Their combined wages were $91,109. They earned a net of $1887 from a rental property they own, and they received $1595 in interest. They

Claimed four exemptions for themselves and two children. They contributed $3701 to their

Tax-deferred retirement plans, and their itemized deductions total $9765. Find their adjusted gross

Income.

A) $81,125

B) $90,890

C) $87,700

D) $108,057

Correct Answer:

Verified

Q173: Solve the equation for the unknown

Q174: Use the given stock table to

Q175: Provide an appropriate response.

-All of your income

Q176: Provide an appropriate response.

-_ loans differ from

Q177: Solve the problem. Refer to the table

Q179: Complete the sentence: On an annual basis

Q180: Assume you have a balance of $3200

Q181: Solve the problem. Refer to the

Q182: Solve the problem.

-Calculate the current yield for

Q183: Provide an appropriate response.

-The bank that pays

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents