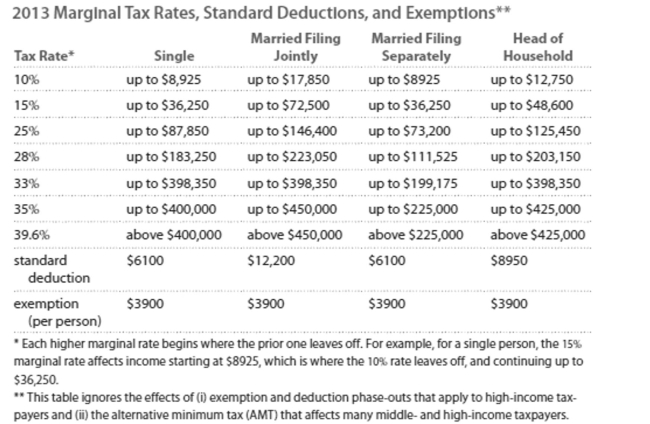

Solve the problem. Refer to the table if necessary.

-Matt is single and earned wages of $32,338. He received $421 in interest from a savings account. He contributed $588 to a tax-deferred retirement plan. He had $579 in itemized deductions from

Charitable contributions. Calculate his taxable income.

A) $25,492

B) $27,692

C) $22,171

D) $37,247

Correct Answer:

Verified

Q172: Determine whether the spending pattern described is

Q173: Solve the equation for the unknown

Q174: Use the given stock table to

Q175: Provide an appropriate response.

-All of your income

Q176: Provide an appropriate response.

-_ loans differ from

Q178: Solve the problem. Refer to the table

Q179: Complete the sentence: On an annual basis

Q180: Assume you have a balance of $3200

Q181: Solve the problem. Refer to the

Q182: Solve the problem.

-Calculate the current yield for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents