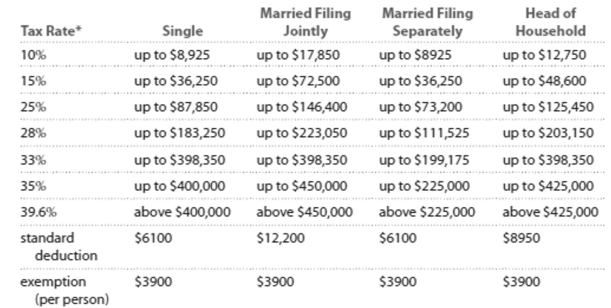

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-You are married filing jointly and have a taxable income of $287,874. You make monthly contributions of $1095 to a tax-deferred savings plan. Calculate the effect on annual take-home pay

Of the tax-deferred contribution.

A) Take-home pay will be $4336 less per year with tax-deferred plan

B) Take-home pay will be $3679 less per year with tax-deferred plan

C) Take-home pay will be $4336 more per year with tax-deferred plan

D) Take-home pay will be $3679 more per year with tax-deferred plan

Correct Answer:

Verified

Q226: Determine whether the spending pattern described is

Q227: Evaluate or simplify the following the

Q228: Provide an appropriate response.

-The _ in financial

Q229: Use the given stock table to answer

Q230: Evaluate or simplify the following the

Q232: Solve the problem. Refer to the

Q233: Provide an appropriate response.

-_ is interest paid

Q234: Use the compound interest formula for

Q235: Answer the question.

-Suppose you are 25 years

Q236: Provide an appropriate response.

-If net income is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents