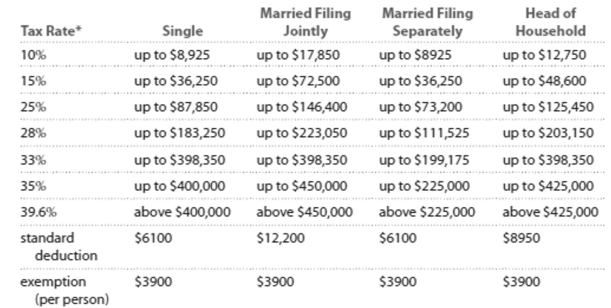

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Your deductible expenditures $4146 for contributions to charity and $635 for state income taxes. Your filing status entitles you to a standard deduction of $6100. Should you itemize your

Deductions rather than claiming the standard deduction? If so, what is the difference?

A) No, you are better off with the standard deduction.

B) Yes, $4781

C) Yes, $2589

D) Yes, $1319

Correct Answer:

Verified

Q227: Evaluate or simplify the following the

Q228: Provide an appropriate response.

-The _ in financial

Q229: Use the given stock table to answer

Q230: Evaluate or simplify the following the

Q231: Solve the problem. Refer to the

Q233: Provide an appropriate response.

-_ is interest paid

Q234: Use the compound interest formula for

Q235: Answer the question.

-Suppose you are 25 years

Q236: Provide an appropriate response.

-If net income is

Q237: Use the given stock table to answer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents