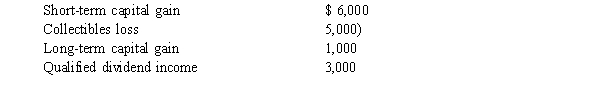

Sanderson has the following capital gains and losses and Qualified dividend income during the current year:  If Sanderson's marginal tax rate is 33%, what is the effect of these transactions on his taxable income and income tax liability?

If Sanderson's marginal tax rate is 33%, what is the effect of these transactions on his taxable income and income tax liability?

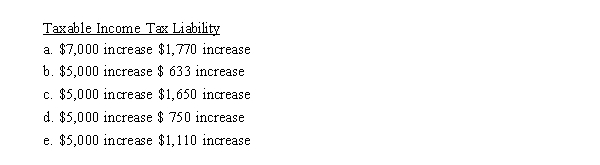

Correct Answer:

Verified

Q106: Under the deferral method of accounting for

Q109: The cash method of accounting for income

Q114: Franco is owner and operator of a

Q115: Angelica has the following capital gains and

Q116: Which of the following payments received on

Q117: Allen has the following capital gains and

Q119: The accrual method I. is permitted for

Q122: Pedro sells land that he held as

Q132: Boomtown Construction,Inc.enters into a contract to build

Q143: On January 1 of the current year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents