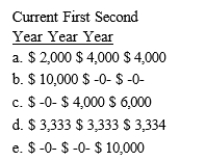

Pedro sells land that he held as an investment with a basis of $40,000 for $50,000. The terms of the sale require the buyer to pay Pedro $10,000 at the closing of the sale and $20,000 per year for the next 2 years with interest at 7% on the unpaid balance. What is the proper amount of gain to be reported from the sale during each year Pedro receives payments?

Correct Answer:

Verified

Q101: The income tax concept that is primarily

Q109: The cash method of accounting for income

Q117: Allen has the following capital gains and

Q118: Sanderson has the following capital gains and

Q119: The accrual method I. is permitted for

Q124: Amanda, who is single, owns 40% of

Q124: Twenty years ago Pricilla purchased an annuity

Q132: Boomtown Construction,Inc.enters into a contract to build

Q140: On December 24 of the current year,

Q143: On January 1 of the current year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents