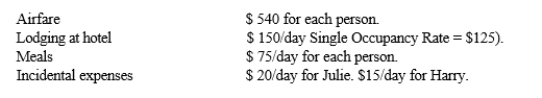

Julie travels to Mobile to meet with a client. While in Mobile, she spends 4 days meeting with the client and one-day sightseeing. Her husband Harry goes with her and spends all 5 days sightseeing and playing golf. The cost of the trip is as follows:  If Julie is self-employed, what is the amount of the deduction she may claim for the trip?

If Julie is self-employed, what is the amount of the deduction she may claim for the trip?

A) $ 730

B) $1,270

C) $1,370

D) $1,420

E) $1,520

Correct Answer:

Verified

Q27: Sandra, who owns a small accounting firm,

Q28: Mercedes is an employee of MWH company

Q28: Carlotta pays $190 to fly from Santa

Q30: Donna is an audit supervisor with the

Q32: In 2014, Eileen, a self-employed nurse, drives

Q34: During 2014, Marsha, an employee of G&H

Q36: Carter is a podiatrist in Minneapolis. He

Q36: During 2014, Jason travels to Miami to

Q37: Walker, an employee of Lakeview Corporation, drives

Q38: Lester uses his personal automobile in his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents