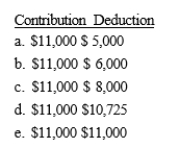

Darlene and Devin are married. Darlene earns $48,000 and Devin earns $41,000. Their adjusted gross income is $97,000. Darlene's employer provides her with a qualified pension plan, Devin's does not. What are Darlene and Devin's maximum combined IRA contribution and deduction amounts?

Correct Answer:

Verified

Q84: Charlie is single and operates his barber

Q89: Margaret is single and is a self-employed

Q92: Natasha is an employee of The Johnson

Q93: Chelsea is an employee of Avondale Company.

Q94: Oliver owns Wifit, an unincorporated sports store.

Q95: Kyle is married and a self-employed landscaper.

Q98: Mathew works for Levitz Mortgage Company. The

Q100: Brees Co. requires its employees to adequately

Q101: Mollie is single and is an employee

Q102: Victor is single and graduated from Wabash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents