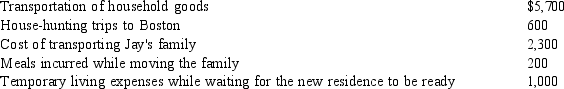

Jay obtains a new job in Boston and moves from Reno during the current year. He incurs the following moving expenses:  What is Jay's moving expense deduction?

What is Jay's moving expense deduction?

A) $ - 0 -

B) $ 5,700

C) $ 8,000

D) $ 9,700

E) $ 9,800

Correct Answer:

Verified

Q107: Laura and Jason are married and have

Q110: Alex and Alicia are married and have

Q121: Which of the following is (are)correct concerning

Q121: Julian and Deloris move during the current

Q125: Jerry recently graduates with an MBA degree

Q126: Assume Sergio is a business associate of

Q131: Carla changes jobs during the year and

Q134: Roscoe is a religion professor. During the

Q141: Walter is a cash basis taxpayer with

Q148: Sally and Kelly are both enrolled in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents